21 Lessons

What I've Learned from Falling Down the Bitcoin Rabbit Hole

“I highly recommend this book. If you’re new to bitcoin, buy it on Amazon. If you’re a Hodler, read the book online and send bitcoin directly* to Gigi.” - Minimal Structure

The White Rabbit put on his spectacles. ‘Where shall I begin, please your Majesty?’ he asked. ‘Begin at the beginning’ the King said gravely, ‘and go on till you come to the end: then stop.’

Ready to enter Wonderland? Follow the white rabbit →

Preface

d

o

w

n

the hOle,

bumped her head

and bruised her soul.

Falling down the Bitcoin rabbit hole is a strange experience. Like many others, I feel like I have learned more in the last couple of years studying Bitcoin than I have during two decades of formal education.

The following lessons are a distillation of what I’ve learned. First published as an article series titled “What I’ve Learned From Bitcoin,”open in new window what follows can be seen as a second edition of the original series.

Like Bitcoin, these lessons aren't a static thing. I plan to work on them periodically, releasing updated versions and additional material in the future.

Unlike Bitcoin, future versions of this project do not have to be backward compatible. Some lessons might be extended, others might be reworked or replaced. I hope that a future version will be something you can hold in your hands, but I don’t want to promise anything just yet.

Bitcoin is an inexhaustible teacher, which is why I do not claim that these lessons are all-encompassing or complete. They are a reflection of my personal journey down the rabbit hole. There are many more lessons to be learned, and every person will learn something different from entering the world of Bitcoin.

I hope that you will find these lessons useful and that the process of learning them by reading won’t be as arduous and painful as learning them firsthand.

Introduction

"Oh, you can’t help that," said the Cat: "we’re all mad here. I’m mad. You’re mad."

"How do you know I’m mad?" said Alice.

"You must be," said the Cat, "or you wouldn’t have come here."

In October 2018, Arjun Balaji asked the innocuous question, What have you learned from Bitcoin?open in new window After trying to answer this question in a short tweet, and failing miserably, I realized that the things I've learned are far too numerous to answer quickly, if at all.

The things I've learned are, obviously, about Bitcoin - or at least related to it. However, while some of the inner workings of Bitcoin are explained, the following lessons are not an explanation of how Bitcoin works or what it is, they might, however, help to explore some of the things Bitcoin touches: philosophical questions, economic realities, and technological innovations.

The 21 lessons are structured in bundles of seven, resulting in three chapters. Each chapter looks at Bitcoin through a different lens, extracting what lessons can be learned by inspecting this strange network from a different angle.

Chapter 1 explores the philosophical teachings of Bitcoin. The interplay of immutability and change, the concept of true scarcity, Bitcoin's immaculate conception, the problem of identity, the contradiction of replication and locality, the power of free speech, and the limits of knowledge.

Chapter 2 explores the economic teachings of Bitcoin. Lessons about financial ignorance, inflation, value, money and the history of money, fractional reserve banking, and how Bitcoin is re-introducing sound money in a sly, roundabout way.

Chapter 3 explores some of the lessons learned by examining the technology of Bitcoin. Why there is strength in numbers, reflections on trust, why telling time takes work, how moving slowly and not breaking things is a feature and not a bug, what Bitcoin's creation can tell us about privacy, why cypherpunks write code (and not laws), and what metaphors might be useful to explore Bitcoin's future.

Each lesson contains several quotes and links throughout the text. If I have explored an idea in more detail, you can find links to my related works in the "Through the Looking-Glass" section. If you like to go deeper, links to the most relevant material are listed in the "Down the Rabbit Hole" section. Both can be found at the end of each lesson.

Even though some prior knowledge about Bitcoin is beneficial, I hope that these lessons can be digested by any curious reader. While some relate to each other, each lesson should be able to stand on its own and can be read independently. I did my best to shy away from technical jargon, even though some domain-specific vocabulary is unavoidable.

I hope that my writing serves as inspiration for others to dig beneath the surface and examine some of the deeper questions Bitcoin raises. My own inspiration came from a multitude of authors and content creators to all of whom I am eternally grateful.

Last but not least: my goal in writing this is not to convince you of anything. My goal is to make you think, and show you that there is way more to Bitcoin than meets the eye. I can’t even tell you what Bitcoin is or what Bitcoin will teach you. You will have to find that out for yourself.

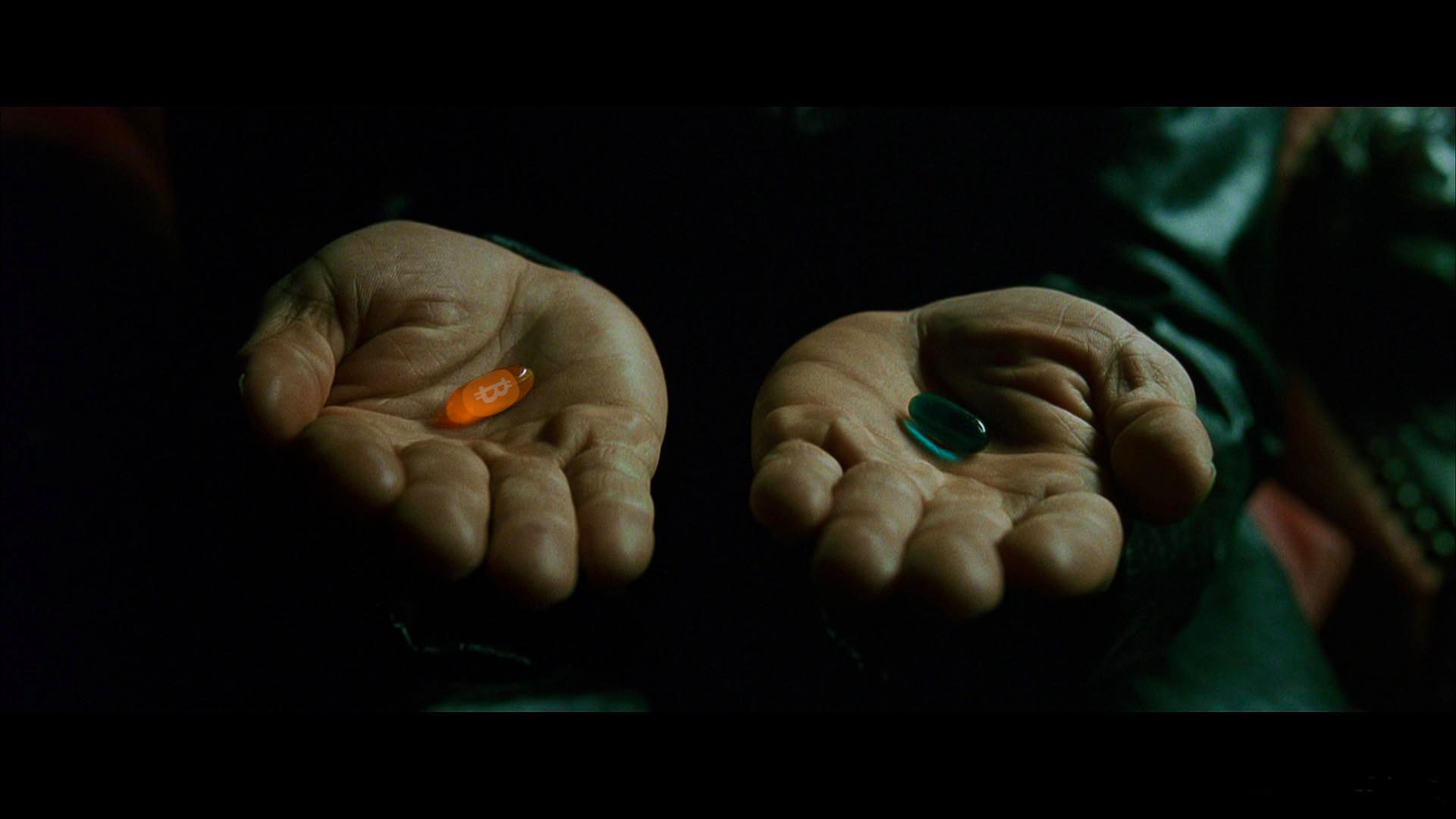

"After this, there is no turning back. You take the blue pill --- the story ends, you wake up in your bed and believe whatever you want to believe. You take the red pill --- you stay in Wonderland, and I show you how deep the rabbit hole goes." Morpheusopen in new window

Chapter I: Philosophy

Looking at Bitcoin superficially, one might conclude that it is slow, wasteful, unnecessarily redundant, and overly paranoid. Looking at Bitcoin inquisitively, one might find out that things are not as they seem at first glance.

Bitcoin has a way of taking your assumptions and turning them on their heads. After a while, just when you were about to get comfortable again, Bitcoin will smash through the wall like a bull in a china shop and shatter your assumptions once more.

Bitcoin is a child of many disciplines. Like blind monks examining an elephant, everyone who approaches this novel technology does so from a different angle. And everyone will come to different conclusions about the nature of the beast.

The following lessons are about some of my assumptions which Bitcoin shattered, and the conclusions I arrived at. Philosophical questions of immutability, scarcity, locality, and identity are explored in the first four lessons.

- Lesson 1: Immutability and change

- Lesson 2: The scarcity of scarcity

- Lesson 3: Replication and locality

- Lesson 4: The problem of identity

- Lesson 5: An immaculate conception

- Lesson 6: The power of free speech

- Lesson 7: The limits of knowledge

Lesson 5 explores how Bitcoin's origin story is not only fascinating but absolutely essential for a leaderless system. The last two lessons of this chapter explore the power of free speech and the limits of our individual knowledge, reflected by the surprising depth of the Bitcoin rabbit hole.

I hope that you will find the world of Bitcoin as educational, fascinating and entertaining as I did and still do. I invite you to follow the white rabbit and explore the depths of this rabbit hole. Now hold on to your pocket watch, pop down, and enjoy the fall.

Lesson 1: Immutability and change

Bitcoin is inherently hard to describe. It is a new thing, and any attempt to draw a comparison to previous concepts --- be it by calling it digital gold or the internet of money --- is bound to fall short of the whole. Whatever your favorite analogy might be, two aspects of Bitcoin are absolutely essential: decentralization and immutability.

One way to think about Bitcoin is as an automated social contractopen in new window. The software is just one piece of the puzzle, and hoping to change Bitcoin by changing the software is an exercise in futility. One would have to convince the rest of the network to adopt the changes, which is more a psychological effort than a software engineering one.

The following might sound absurd at first, like so many other things in this space, but I believe that it is profoundly true nonetheless: You won't change Bitcoin, but Bitcoin will change you.

"Bitcoin will change us more than we will change it." - Marty Bentopen in new window

It took me a long time to realize the profundity of this. Since Bitcoin is just software and all of it is open-source, you can simply change things at will, right? Wrong. Very wrong. Unsurprisingly, Bitcoin's creator knew this all too well.

The nature of Bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime. - Satoshi Nakamotoopen in new window

Many people have attempted to change Bitcoin's nature. So far all of them have failed. While there is an endless sea of forks and altcoins, the Bitcoin network still does its thing, just as it did when the first node went online. The altcoins won't matter in the long run. The forks will eventually starve to death. Bitcoin is what matters. As long as our fundamental understanding of mathematics and/or physics doesn't change, the Bitcoin honeybadger will continue to not care.

"Bitcoin is the first example of a new form of life. It lives and breathes on the internet. It lives because it can pay people to keep it alive. [...] It can't be changed. It can't be argued with. It can't be tampered with. It can't be corrupted. It can't be stopped. [...] If nuclear war destroyed half of our planet, it would continue to live, uncorrupted. " - Ralph Merkleopen in new window

The heartbeat of the Bitcoin network will outlast all of ours.

Realizing the above changed me way more than the past blocks of the Bitcoin blockchain ever will. It changed my time preference, my understanding of economics, my political views, and so much more. Hell, it is even changing people's dietsopen in new window. If all of this sounds crazy to you, you're in good company. All of this is crazy, and yet it is happening.

Bitcoin taught me that it won't change. I will.

Lesson 2: The Scarcity of Scarcity

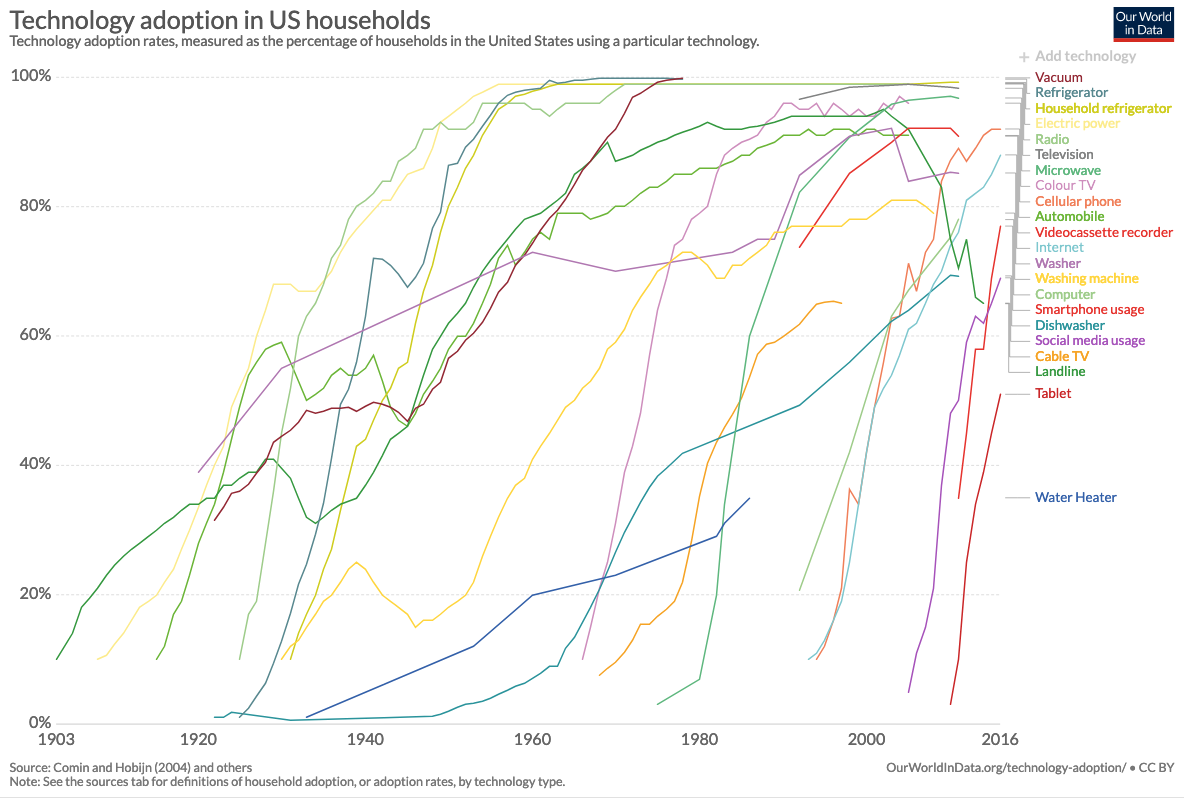

In general, the advance of technology seems to make things more abundant. More and more people are able to enjoy what previously have been luxurious goods. Soon, we will all live like kings. Most of us already do. As Peter Diamandis wrote in Abundanceopen in new window: "Technology is a resource-liberating mechanism. It can make the once scarce the now abundant."

Bitcoin, an advanced technology in itself, breaks this trend and creates a new commodity which is truly scarce. Some even argue that it is one of the scarcest things in the universe. The supply can't be inflated, no matter how much effort one chooses to expend towards creating more.

"Only two things are genuinely scarce: time and bitcoin." - Saifedean Ammousopen in new window

Paradoxically, it does so by a mechanism of copying. Transactions are broadcast, blocks are propagated, the distributed ledger is --- well, you guessed it --- distributed. All of these are just fancy words for copying. Heck, Bitcoin even copies itself onto as many computers as it can, by incentivizing individual people to run full nodes and mine new blocks.

All of this duplication wonderfully works together in a concerted effort to produce scarcity.

In a time of abundance, Bitcoin taught me what real scarcity is.

Lesson 3: Replication and locality

Quantum mechanics aside, locality is a non-issue in the physical world. The question "Where is X?" can be answered in a meaningful way, no matter if X is a person or an object. In the digital world, the question of where is already a tricky one, but not impossible to answer. Where are your emails, really? A bad answer would be "the cloud", which is just someone else's computer. Still, if you wanted to track down every storage device which has your emails on it you could, in theory, locate them.

With bitcoin, the question of "where" is really tricky. Where, exactly, are your bitcoins?

"I opened my eyes, looked around, and asked the inevitable, the traditional, the lamentably hackneyed postoperative question: 'Where am l?'" - Daniel Dennettopen in new window

The problem is twofold: First, the distributed ledger is distributed by full replication, meaning the ledger is everywhere. Second, there are no bitcoins. Not only physically, but technically.

Bitcoin keeps track of a set of unspent transaction outputs, without ever having to refer to an entity which represents a bitcoin. The existence of a bitcoin is inferred by looking at the set of unspent transaction outputs and calling every entry with 100 million base units a bitcoin.

"Where is it, at this moment, in transit? [...] First, there are no bitcoins. There just aren't. They don't exist. There are ledger entries in a ledger that's shared [...] They don't exist in any physical location. The ledger exists in every physical location, essentially. Geography doesn't make sense here --- it is not going to help you figuring out your policy here." - Peter Van Valkenburghopen in new window

So, what do you actually own when you say "I have a bitcoin" if there are no bitcoins? Well, remember all these strange words which you were forced to write down by the wallet you used? Turns out these magic words are what you own: a magic spellopen in new window which can be used to add some entries to the public ledger --- the keys to "move" some bitcoins. This is why, for all intents and purposes, your private keys are your bitcoins. If you think I'm making all of this up feel free to send me your private keys.

Bitcoin taught me that locality is a tricky business.

Lesson 4: The problem of identity

Nic Carter, in an homage to Thomas Nagel's treatment of the same question in regards to a batopen in new window, wrote an excellent piece which discusses the following question: What is it like to be a bitcoin?open in new window He brilliantly shows that open, public blockchains in general, and Bitcoin in particular, suffer from the same conundrum as the Ship of Theseusopen in new window: which Bitcoin is the real Bitcoin?

"Consider just how little persistence Bitcoin's components have. The entire codebase has been reworked, altered, and expanded such that it barely resembles its original version. [...] The registry of who owns what, the ledger itself, is virtually the only persistent trait of the network [...]

To be considered truly leaderless, you must surrender the easy solution of having an entity that can designate one chain as the legitimate one." - Nic Carteropen in new window

It seems like the advancement of technology keeps forcing us to take these philosophical questions seriously. Sooner or later, self-driving cars will be faced with real-world versions of the trolley problemopen in new window, forcing them to make ethical decisions about whose lives do matter and whose do not.

Cryptocurrencies, especially since the first contentious hard-fork, force us to think about and agree upon the metaphysics of identity. Interestingly, the two biggest examples we have so far have lead to two different answers. On August 1, 2017, Bitcoin split into two camps. The market decided that the unaltered chain is the original Bitcoin. One year earlier, on October 25, 2016, Ethereum split into two camps. The market decided that the altered chain is the original Ethereum.

If properly decentralized, the questions posed by the Ship of Theseus will have to be answered in perpetuity for as long as these networks of value-transfer exist.

Bitcoin taught me that decentralization contradicts identity.

Lesson 5: An immaculate conception

Everyone loves a good origin story. The origin story of Bitcoin is a fascinating one, and the details of it are more important than one might think at first. Who is Satoshi Nakamoto? Was he one person or a group of people? Was he a she? Time-traveling alien, or advanced AI? Outlandish theories aside, we will probably never know. And this is important.

Satoshi chose to be anonymous. He planted the seed of Bitcoin. He stuck around for long enough to make sure the network won't die in its infancy. And then he vanished.

What might look like a weird anonymity stunt is actually crucial for a truly decentralized system. No centralized control. No centralized authority. No inventor. No-one to prosecute, torture, blackmail, or extort. An immaculate conception of technology.

"One of the greatest things that Satoshi did was disappear." - Jimmy Songopen in new window

Since the birth of Bitcoin, thousands of other cryptocurrencies were created. None of these clones share its origin story. If you want to supersede Bitcoin, you will have to transcend its origin story. In a war of ideas, narratives dictate survival.

"Gold was first fashioned into jewelry and used for barter over 7,000 years ago. Gold's captivating gleam led to it being considered a gift from the gods." - Gold: The Extraordinary Metalopen in new window

Like gold in ancient times, Bitcoin might be considered a gift from the gods. Unlike gold, Bitcoins origins are all too human. And this time, we know who the gods of development and maintenance are: people all over the world, anonymous or not.

Bitcoin taught me that narratives are important.

Lesson 6: The power of free speech

Bitcoin is an idea. An idea which, in its current form, is the manifestation of a machinery purely powered by text. Every aspect of Bitcoin is text: The whitepaper is text. The software which is run by its nodes is text. The ledger is text. Transactions are text. Public and private keys are text. Every aspect of Bitcoin is text, and thus equivalent to speech.

"Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances." - First Amendment to the United States Constitutionopen in new window

Although the final battle of the Crypto Warsopen in new window has not been fought yet, it will be very difficult to criminalize an idea, let alone an idea which is based on the exchange of text messages. Every time a government tries to outlaw text or speech, we slip down a path of absurdity which inevitably leads to abominations like illegal numbersopen in new window and illegal primesopen in new window.

As long as there is a part of the world where speech is free as in freedom, Bitcoin is unstoppable.

"There is no point in any Bitcoin transaction that Bitcoin ceases to be text. It is all text, all the time. [...]

Bitcoin is text. Bitcoin is speech. It cannot be regulated in a free country like the USA with guaranteed inalienable rights and a First Amendment that explicitly excludes the act of publishing from government oversight." - Beautyonopen in new window

Bitcoin taught me that in a free society, free speech and free software are unstoppable.

Lesson 7: The limits of knowledge

Getting into Bitcoin is a humbling experience. I thought that I knew things. I thought that I was educated. I thought that I knew my computer science, at the very least. I studied it for years, so I have to know everything about digital signatures, hashes, encryption, operational security, and networks, right?

Wrong.

Learning all the fundamentals which make Bitcoin work is hard. Understanding all of them deeply is borderline impossible.

"No one has found the bottom of the Bitcoin rabbit hole."- Jameson Loppopen in new window

My list of books to read keeps expanding way quicker than I could possibly read them. The list of papers and articles to read is virtually endless. There are more podcasts on all of these topics than I could ever listen to. It truly is humbling. Further, Bitcoin is evolving and it's almost impossible to stay up-to-date with the accelerating rate of innovation. The dust of the first layer hasn't even settled yet, and people have already built the second layer and are working on the third.

Bitcoin taught me that I know very little about almost anything. It taught me that this rabbit hole is bottomless.

Chapter II: Economics

Money doesn’t grow on trees. To believe that it does is foolish, and our parents make sure that we know about that by repeating this saying like a mantra. We are encouraged to use money wisely, to not spend it frivolously, and to save it in good times to help us through the bad. Money, after all, does not grow on trees.

Bitcoin taught me more about money than I ever thought I would need to know. Through it, I was forced to explore the history of money, banking, various schools of economic thought, and many other things. The quest to understand Bitcoin lead me down a plethora of paths, some of which I try to explore in this series.

In the first seven lessons some of the philosophical questions Bitcoin touches on were discussed. The next seven lessons will take a closer look at money and economics.

- Lesson 8: Financial ignorance

- Lesson 9: Inflation

- Lesson 10: Value

- Lesson 11: Money

- Lesson 12: The history and downfall of money

- Lesson 13: Fractional Reserve Insanity

- Lesson 14: Sound money

Again, I will only be able to scratch the surface. Bitcoin is not only ambitious, but also broad and deep in scope, making it impossible to cover all relevant topics in a single lesson, essay, article, or book. I doubt if it is even possible at all.

Bitcoin is a new form of money, which makes learning about economics paramount to understanding it. Dealing with the nature of human action and the interactions of economic agents, economics is probably one of the largest and fuzziest pieces of the Bitcoin puzzle.

Again, these lessons are an exploration of the various things I have learned from Bitcoin. They are a personal reflection of my journey down the rabbit hole. Having no background in economics, I am definitely out of my comfort zone and especially aware that any understanding I might have is incomplete. I will do my best to outline what I have learned, even at the risk of making a fool out of myself. After all, I am still trying to answer the question: “What have you learned from Bitcoin?”open in new window

After seven lessons examined through the lens of philosophy, let’s use the lens of economics to look at seven more. Economy class is all I can offer this time. Final destination: sound money.

Lesson 8: Financial ignorance

One of the most surprising things, to me, was the amount of finance, economics, and psychology required to get a grasp of what at first glance seems to be a purely technical system --- a computer network. To paraphrase a little guy with hairy feet: "It's a dangerous business, Frodo, stepping into Bitcoin. You read the whitepaper, and if you don't keep your feet, there's no knowing where you might be swept off to."

To understand a new monetary system, you have to get acquainted with the old one. I began to realize very soon that the amount of financial education I enjoyed in the educational system was essentially zero.

Like a five-year-old, I began to ask myself a lot of questions: How does the banking system work? How does the stock market work? What is fiat money? What is regular money? Why is there so much debtopen in new window? How much money is actually printed, and who decides that?

After a mild panic about the sheer scope of my ignorance, I found reassurance in realizing that I was in good company.

"Isn't it ironic that Bitcoin has taught me more about money than all these years I've spent working for financial institutions? ...including starting my career at a central bank" - aarontayccopen in new window

"I've learned more about finance, economics, technology, cryptography, human psychology, politics, game theory, legislation, and myself in the last three months of crypto than the last three and a half years of college" - bitcoindunnyopen in new window

These are just two of the many confessionsopen in new window all over twitter. Bitcoin, as was explored in Lesson 1, is a living thing. Mises argued that economics also is a living thing. And as we all know from personal experience, living things are inherently difficult to understand.

"A scientific system is but one station in an endlessly progressing search for knowledge. It is necessarily affected by the insufficiency inherent in every human effort. But to acknowledge these facts does not mean that present-day economics is backward. It merely means that economics is a living thing --- and to live implies both imperfection and change." - Ludwig von Misesopen in new window

We all read about various financial crises in the news, wonder about how these big bailouts work and are puzzled over the fact that no one ever seems to be held accountable for damages which are in the trillions. I am still puzzled, but at least I am starting to get a glimpse of what is going on in the world of finance.

Some people even go as far as to attribute the general ignorance on these topics to systemic, willful ignorance. While history, physics, biology, math, and languages are all part of our education, the world of money and finance surprisingly is only explored superficially, if at all. I wonder if people would still be willing to accrue as much debt as they currently do if everyone would be educated in personal finance and the workings of money and debt. Then I wonder how many layers of aluminum make an effective tinfoil hat. Probably three.

"Those crashes, these bailouts, are not accidents. And neither is it an accident that there is no financial education in school. [...] It's premeditated. Just as prior to the Civil War it was illegal to educate a slave, we are not allowed to learn about money in school." - Robert Kiyosakiopen in new window

Like in The Wizard of Oz, we are told to pay no attention to the man behind the curtain. Unlike in The Wizard of Oz, we now have real wizardryopen in new window: a censorship-resistant, open, borderless network of value-transfer. There is no curtain, and the magic is visible to anyoneopen in new window.

Bitcoin taught me to look behind the curtain and face my financial ignorance.

Lesson 9: Inflation

Trying to understand monetary inflation, and how a non-inflationary system like Bitcoin might change how we do things, was the starting point of my venture into economics. I knew that inflation was the rate at which new money was created, but I didn't know too much beyond that.

While some economists argue that inflation is a good thing, others argue that "hard" money which can't be inflated easily --- as we had in the days of the gold standard --- is essential for a healthy economy. Bitcoin, having a fixed supply of 21 million, agrees with the latter camp.

Usually, the effects of inflation are not immediately obvious. Depending on the inflation rate (as well as other factors) the time between cause and effect can be several years. Not only that, but inflation affects different groups of people more than others. As Henry Hazlitt points out in Economics in One Lesson: "The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups."

One of my personal lightbulb moments was the realization that issuing new currency --- printing more money --- is a completely different economic activity than all the other economic activities. While real goods and real services produce real value for real people, printing money effectively does the opposite: it takes away value from everyone who holds the currency which is being inflated.

"Mere inflation --- that is, the mere issuance of more money, with the consequence of higher wages and prices --- may look like the creation of more demand. But in terms of the actual production and exchange of real things it is not." - Henry Hazlittopen in new window

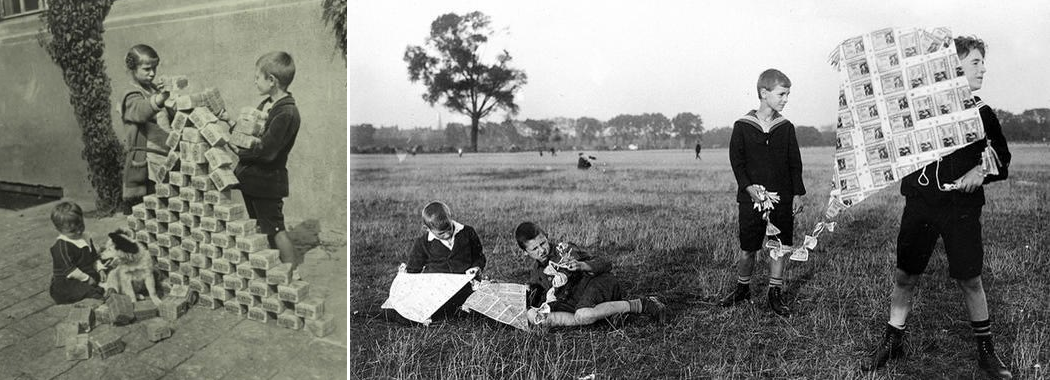

The destructive force of inflation becomes obvious as soon as a little inflation turns into a lot. If money hyperinflatesopen in new window, things get ugly real quick. As the inflating currency falls apart, it will fail to store value over time and people will rush to get their hands on any goods which might do.

Another consequence of hyperinflation is that all the money which people have saved over the course of their life will effectively vanish. The paper money in your wallet will still be there, of course. But it will be exactly that: worthless paper.

Money declines in value with so-called "mild" inflation as well. It just happens slowly enough that most people don't notice the diminishing of their purchasing power. And once the printing presses are running, currency can be easily inflated, and what used to be mild inflation might turn into a strong cup of inflation by the push of a button. As Friedrich Hayek pointed out in one of his essays, mild inflation usually leads to outright inflation.

""Mild" steady inflation cannot help --- it can lead only to outright inflation." - Friedrich Hayekopen in new window

Inflation is particularly devious since it favors those who are closer to the printing presses. It takes time for the newly created money to circulate and prices to adjust, so if you are able to get your hands on more money before everyone else's devaluates you are ahead of the inflationary curve. This is also why inflation can be seen as a hidden tax because in the end governments profit from it while everyone else ends up paying the price.

"I do not think it is an exaggeration to say history is largely a history of inflation, and usually of inflations engineered by governments for the gain of governments." Friedrich Hayekopen in new window

So far, all government-controlled currencies have eventually been replaced or have collapsed completely. No matter how small the rate of inflation, "steady" growth is just another way of saying exponential growth. In nature as in economics, all systems which grow exponentially will eventually have to level off or suffer from catastrophic collapse.

"It can't happen in my country," is what you're probably thinking. You don't think that if you are from Venezuela, which is currently sufferingopen in new window from hyperinflation. With an inflation rate of over 1 million percent, money is basically worthless.

It might not happen in the next couple of years, or to the particular currency used in your country. But a glance at the list of historical currenciesopen in new window shows that it will inevitably happen over a long enough period of time. I remember and used plenty of those listed: the Austrian schilling, the German mark, the Italian lira, the French franc, the Irish pound, the Croatian dinar, etc. My grandma even used the Austro-Hungarian Krone. As time moves on, the currencies currently in useopen in new window will slowly but surely move to their respective graveyards. They will hyperinflate or be replaced. They will soon be historical currencies. We will make them obsolete.

"History has shown that governments will inevitably succumb to the temptation of inflating the money supply." - Saifedean Ammousopen in new window

Why is Bitcoin different? In contrast to currencies mandated by the government, monetary goods which are not regulated by governments, but by the laws of physicsopen in new window, tend to survive and even hold their respective value over time. The best example of this so far is gold, which, as the aptly-named Gold-to-Decent-Suit Ratioopen in new window shows, is holding its value over hundreds and even thousands of years. It might not be perfectly "stable" --- a questionable concept in the first place --- but the value it holds will at least be in the same order of magnitude.

If a monetary good or currency holds its value well over time and space, it is considered to be hard. If it can't hold its value, because it easily deteriorates or inflates, it is considered a soft currency. The concept of hardness is essential to understand Bitcoin and is worthy of a more thorough examination. We will return to it in the last economic lesson: sound money.

As more and more countries suffer from hyperinflationopen in new window, more and more people will have to face the reality of hard and soft money. If we are lucky, maybe even some central bankers will be forced to re-evaluate their monetary policies. Whatever might happen, the insights I have gained thanks to Bitcoin will probably be invaluable, no matter the outcome.

Bitcoin taught me about the hidden tax of inflation and the catastrophe of hyperinflation.

Lesson 10: Value

Value is somewhat paradoxical, and there are multiple theoriesopen in new window which try to explain why we value certain things over other things. People have been aware of this paradox for thousands of years. As Plato wrote in his dialogue with Euthydemus, we value some things because they are rare, and not merely based on their necessity for our survival.

"And if you are prudent you will give this same counsel to your pupils also --- that they are never to converse with anybody except you and each other. For it is the rare, Euthydemus, that is precious, while water is cheapest, though best, as Pindar said." - Platoopen in new window

This paradox of valueopen in new window shows something interesting about us humans: we seem to value things on a subjectiveopen in new window basis, but do so with certain non-arbitrary criteria. Something might be precious to us for a variety of reasons, but things we value do share certain characteristics. If we can copy something very easily, or if it is naturally abundant, we do not value it.

It seems that we value something because it is scarce (gold, diamonds, time), difficult or labor-intensive to produce, can't be replaced (an old photograph of a loved one), is useful in a way in which it enables us to do things which we otherwise couldn't, or a combination of those, such as great works of art.

Bitcoin is all of the above: it is extremely rare (21 million), increasingly hard to produce (reward halvening), can't be replaced (a lost private key is lost forever), and enables us to do some quite useful things. It is arguably the best tool for value transfer across borders, virtually resistant to censorship and confiscation in the process, plus, it is a self-sovereign store of value, allowing individuals to store their wealth independent of banks and governments, just to name two.

Bitcoin taught me that value is subjective but not arbitrary.

Lesson 11: Money

"I kept all my limbs very supple,

By the use of this ointment, five shillings the box—

Allow me to sell you a couple."

"

What is money? We use it every day, yet this question is surprisingly difficult to answer. We are dependent on it in ways big and small, and if we have too little of it our lives become very difficult. Yet, we seldom think about the thing which supposedly makes the world go round. Bitcoin forced me to answer this question over and over again: What the hell is money?

In our "modern" world, most people will probably think of pieces of paper when they talk about money, even though most of our money is just a number in a bank account. We are already using zeros and ones as our money, so how is Bitcoin different? Bitcoin is different because at its core it is a very different type of money than the money we currently use. To understand this, we will have to take a closer look at what money is, how it came to be, and why gold and silver was used for most of commercial history.

"In this sense, it's more typical of a precious metal. Instead of the supply changing to keep the value the same, the supply is predetermined and the value changes." - Satoshi Nakamotoopen in new window

Seashells, gold, silver, paper, bitcoin. In the end, money is whatever people use as money, no matter its shape and form, or lack thereof.

Money, as an invention, is ingenious. A world without money is insanely complicated: How many fish will buy me new shoes? How many cows will buy me a house? What if I don't need anything right now but I need to get rid of my soon-to-be rotten apples? You don't need a lot of imagination to realize that a barter economy is maddeningly inefficient.

The great thing about money is that it can be exchanged for anything else --- that's quite the invention! As Nick Szaboopen in new window brilliantly summarizes in Shelling Out: The Origins of Moneyopen in new window, we humans have used all kinds of things as money: beads made of rare materials like ivory, shells, or special bones, various kinds of jewelry, and later on rare metals like silver and gold.

Being the lazy creatures we are, we don't think too much about things which just work. Money, for most of us, works just fine. Like with our cars or our computers, most of us are only forced to think about the inner workings of these things if they break down. People who saw their life-savings vanish because of hyperinflation know the value of hard money, just like people who saw their friends and family vanish because of the atrocities of Nazi Germany or Soviet Russia know the value of privacy.

The thing about money is that it is all-encompassing. Money is half of every transaction, which imbues the ones who are in charge with creating money with enormous power.

"Given that money is one half of every commercial transaction and that whole civilizations literally rise and fall based on the quality of their money, we are talking about an awesome power, one that flies under the cover of night. It is the power to weave illusions that appear real as long as they last. That is the very core of the Fed's power." - Ron Paulopen in new window

Bitcoin peacefully removes this power, since it does away with money creation and it does so without the use of force.

Money went through multiple iterations. Most iterations were good. They improved our money in one way or another. Very recently, however, the inner workings of our money got corrupted. Today, almost all of our money is simply created out of thin air by the powers that be. To understand how this came to be I had to learn about the history and subsequent downfall of money.

If it will take a series of catastrophes or simply a monumental educational effort to correct this corruption remains to be seen. I pray to the gods of sound money that it will be the latter.

Bitcoin taught me what money is.

Lesson 12: The history and downfall of money

Many people think that money is backed by gold, which is locked away in big vaults, protected by thick walls. This ceased to be true many decades ago. I am not sure what I thought, since I was in much deeper trouble, having virtually no understanding of gold, paper money, or why it would need to be backed by something in the first place.

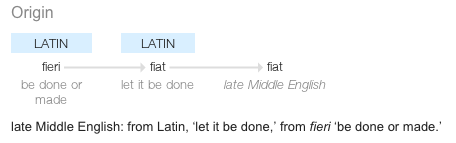

One part of learning about Bitcoin is learning about fiat money: what it means, how it came to be, and why it might not be the best idea we ever had. So, what exactly is fiat money? And how did we end up using it?

If something is imposed by fiat, it simply means that it is imposed by formal authorization or proposition. Thus, fiat money is money simply because someone says that it is money. Since all governments use fiat currency today, this someone is your government. Unfortunately, you are not free to disagree with this value proposition. You will quickly feel that this proposition is everything but non-violent. If you refuse to use this paper currency to do business and pay taxes the only people you will be able to discuss economics with will be your cellmates.

The value of fiat money does not stem from its inherent properties. How good a certain type of fiat money is, is only correlated to the political and fiscal (in)stability of those who dream it into existence. Its value is imposed by decree, arbitrarily.

Until recently, two types of money were used: commodity money, made out of precious things, and representative money, which simply represents the precious thing, mostly in writing.

We already touched on commodity money above. People used special bones, seashells, and precious metals as money. Later on, mainly coins made out of precious metals like gold and silver were used as money. The oldest coinopen in new window found so far is made of a natural gold-and-silver mix and was made more than 2700 years ago. If something is new in Bitcoin, the concept of a coin is not it.

Turns out that hoarding coins, or hodling, to use today's parlance, is almost as old as coins. The earliest coin hodler was someone who put almost a hundred of these coins in a pot and buried it in the foundations of a temple, only to be found 2500 years later. Pretty good cold storage if you ask me.

One of the downsides of using precious metal coins is that they can be clipped, effectively debasing the value of the coin. New coins can be minted from the clippings, inflating the money supply over time, devaluing every individual coin in the process. People were literally shaving off as much as they could get away with of their silver dollars. I wonder what kind of Dollar Shave Club advertisements they had back in the day.

Since governments are only cool with inflation if they are the ones doing it, efforts were made to stop this guerrilla debasement. In classic cops-and-robbers fashion, coin clippers got ever more creative with their techniques, forcing the 'masters of the mint' to get even more creative with their countermeasures. Isaac Newton, the world-renowned physicist of Principia Mathematica fame, used to be one of these masters. He is attributed with adding the small stripes at the side of coins which are still present today. Gone were the days of easy coin shaving.

Even with these methods of coin debasementopen in new window kept in check, coins still suffer from other issues. They are bulky and not very convenient to transport, especially when large transfers of value need to happen. Showing up with a huge bag of silver dollars every time you want to buy a Mercedes isn't very practical.

Speaking of German things: How the United States dollar got its name is another interesting story. The word "dollar" is derived from the German word Thaleropen in new window, short for a Joachimsthaler. A Joachimsthaler was a coin minted in the town of Sankt Joachimsthal. Thaler is simply a shorthand for someone (or something) coming from the valley, and because Joachimsthal was the valley for silver coin production, people simply referred to these silver coins as Thaler. Thaler (German) morphed into daalders (Dutch), and finally dollars (English).

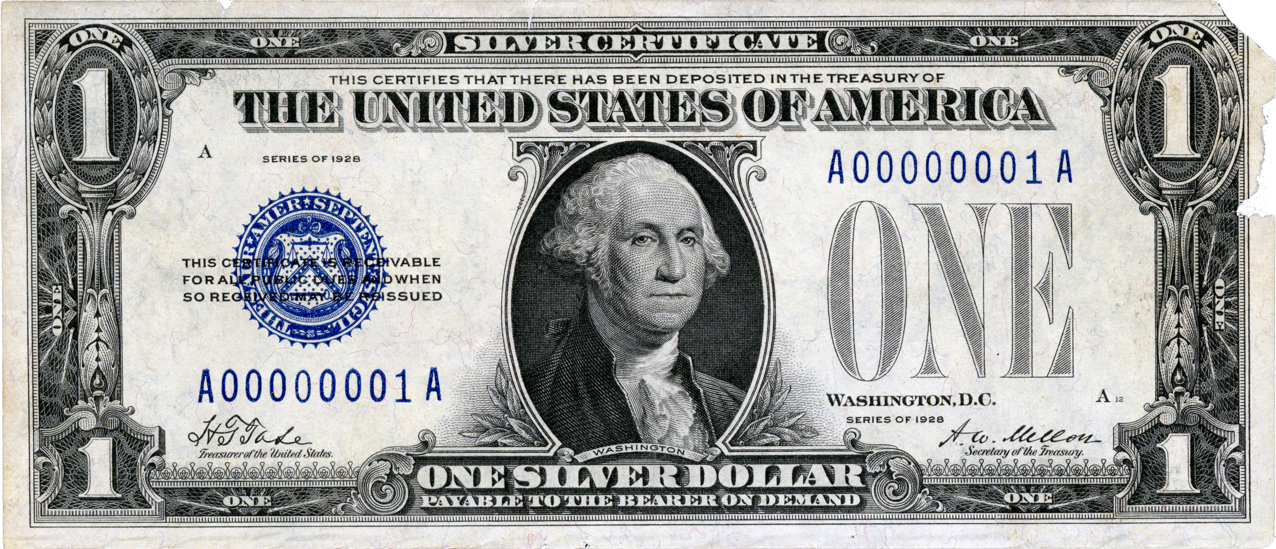

The introduction of representative money heralded the downfall of hard money. Gold certificates were introduced in 1863, and about fifteen years later, the silver dollar was also slowly but surely being replaced by a paper proxy: the silver certificate.

It took about 50 years from the introduction of the first silver certificatesopen in new window until these pieces of paper morphed into something that we would today recognize as one U.S. dollar.

Note that the 1928 U.S. silver dollar above still goes by the name of silver certificate, indicating that this is indeed simply a document stating that the bearer of this piece of paper is owed a piece of silver. It is interesting to see that the text which indicates this got smaller over time. The trace of "certificate" vanished completely after a while, being replaced by the reassuring statement that these are federal reserve notes.

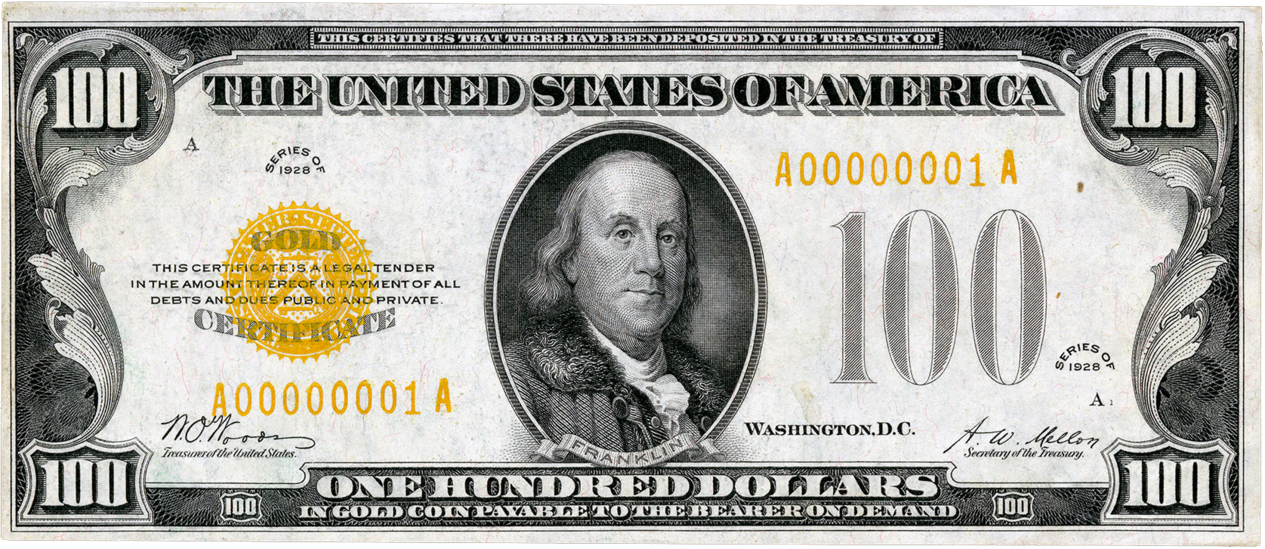

As mentioned above, the same thing happened to gold. Most of the world was on a bimetallic standardopen in new window, meaning coins were made primarily of gold and silver. Having certificates for gold, redeemable in gold coins, was arguably a technological improvement. Paper is more convenient, lighter, and since it can be divided arbitrarily by simply printing a smaller number on it, it is easier to break into smaller units.

To remind the bearers (users) that these certificates were representative for actual gold and silver, they were colored accordingly and stated this clearly on the certificate itself. You can fluently read the writing from top to bottom:

"This certifies that there have been deposited in the treasury of the United States of America one hundred dollars in gold coin payable to the bearer on demand."

In 1963, the words "PAYABLE TO THE BEARER ON DEMAND" were removed from all newly issued notes. Five years later, the redemption of paper notes for gold and silver ended.

The words hinting on the origins and the idea behind paper money were removed. The golden color disappeared. All that was left was the paper and with it the ability of the government to print as much of it as it wishes.

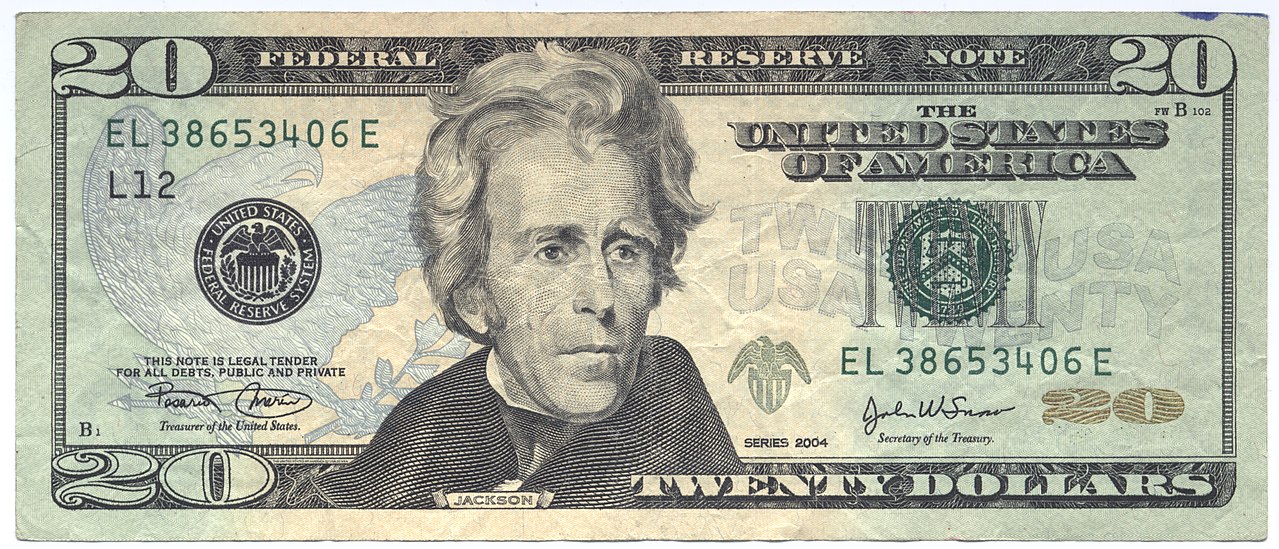

With the abolishment of the gold standard in 1971, this century-long sleight-of-hand was complete. Money became the illusion we all share to this day: fiat money. It is worth something because someone commanding an army and operating jails says it is worth something. As can be clearly read on every dollar note in circulation today, "THIS NOTE IS LEGAL TENDER". In other words: It is valuable because the note says so.

By the way, there is another interesting lesson on today's bank notes, hidden in plain sight. The second line reads that this is legal tender "FOR ALL DEBTS, PUBLIC AND PRIVATE". What might be obvious to economists was surprising to me: All money is debt. My head is still hurting because of it, and I will leave the exploration of the relation of money and debt as an exercise to the reader.

As we have seen, gold and silver were used as money for millennia. Over time, coins made from gold and silver were replaced by paper. Paper slowly became accepted as payment. This acceptance created an illusion --- the illusion that the paper itself has value. The final move was to completely sever the link between the representation and the actual: abolishing the gold standard and convincing everyone that the paper in itself is precious.

Bitcoin taught me about the history of money and the greatest sleight of hand in the history of economics: fiat currency.

Lesson 13: Fractional Reserve Insanity

Value and money aren't trivial topics, especially in today's times. The process of money creation in our banking system is equally non-trivial, and I can't shake the feeling that this is deliberately so. What I have previously only encountered in academia and legal texts seems to be common practice in the financial world as well: nothing is explained in simple terms, not because it is truly complex, but because the truth is hidden behind layers and layers of jargon and apparent complexity. "Expansionary monetary policy, quantitative easing, fiscal stimulus to the economy." The audience nods along in agreement, hypnotized by the fancy words.

Fractional reserve banking and quantitative easing are two of those fancy words, obfuscating what is really happening by masking it as complex and difficult to understand. If you would explain them to a five-year-old, the insanity of both will become apparent quickly.

Godfrey Bloom, addressing the European Parliament during a joint debateopen in new window, said it way better than I ever could:

"[...] you do not really understand the concept of banking. All the banks are broke. Bank Santander, Deutsche Bank, Royal Bank of Scotland --- they're all broke! And why are they broke? It isn't an act of God. It isn't some sort of tsunami. They're broke because we have a system called 'fractional reserve banking' which means that banks can lend money that they don't actually have! It's a criminal scandal and it's been going on for too long. [...]

We have counterfeiting --- sometimes called quantitative easing --- but counterfeiting by any other name. The artificial printing of money which, if any ordinary person did, they'd go to prison for a very long time [...] and until we start sending bankers --- and I include central bankers and politicians --- to prison for this outrage it will continue." - [Godfrey Bloom]joint debateopen in new window

Let me repeat the most important part: banks can lend money that they don't actually have.

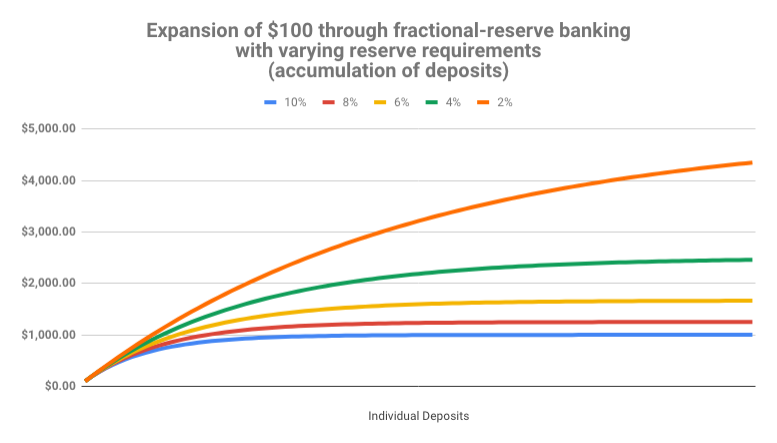

Thanks to fractional reserve banking, a bank only has to keep a small fraction of every dollar it gets. It's somewhere between 0 and 10%, usually at the lower end, which makes things even worse.

Let's use a concrete example to better understand this crazy idea: A fraction of 10% will do the trick and we should be able to do all the calculations in our head. Win-win. So, if you take $100 to a bank --- because you don't want to store it under your mattress --- they only have to keep the agreed upon fraction of it. In our example that would be $10, because 10% of $100 is $10. Easy, right?

So what do banks do with the rest of the money? What happens to your $90? They do what banks do, they lend it to other people. The result is a money multiplieropen in new window effect, which increases the money supply in the economy enormously. Your initial deposit of $100 will soon turn into $190. By lending a 90% fraction of the newly created $90, there will soon be $271 in the economy. And $343.90 after that. The money supply is recursively increasing, since banks are literally lending money they don't have. Without a single Abracadabra, banks magically transform $100 into one thousand dollars or more. Turns out 10x is easy. It only takes a couple of lending rounds.

Don't get me wrong: There is nothing wrong with lending. There is nothing wrong with interest. There isn't even anything wrong with good old regular banks to store your wealth somewhere more secure than in your sock drawer.

Central banks, however, are a different beast. Abominations of financial regulation, half public half private, playing god with something which affects everyone who is part of our global civilization, without a conscience, only interested in the immediate future, and seemingly without any accountability or auditabilityopen in new window.

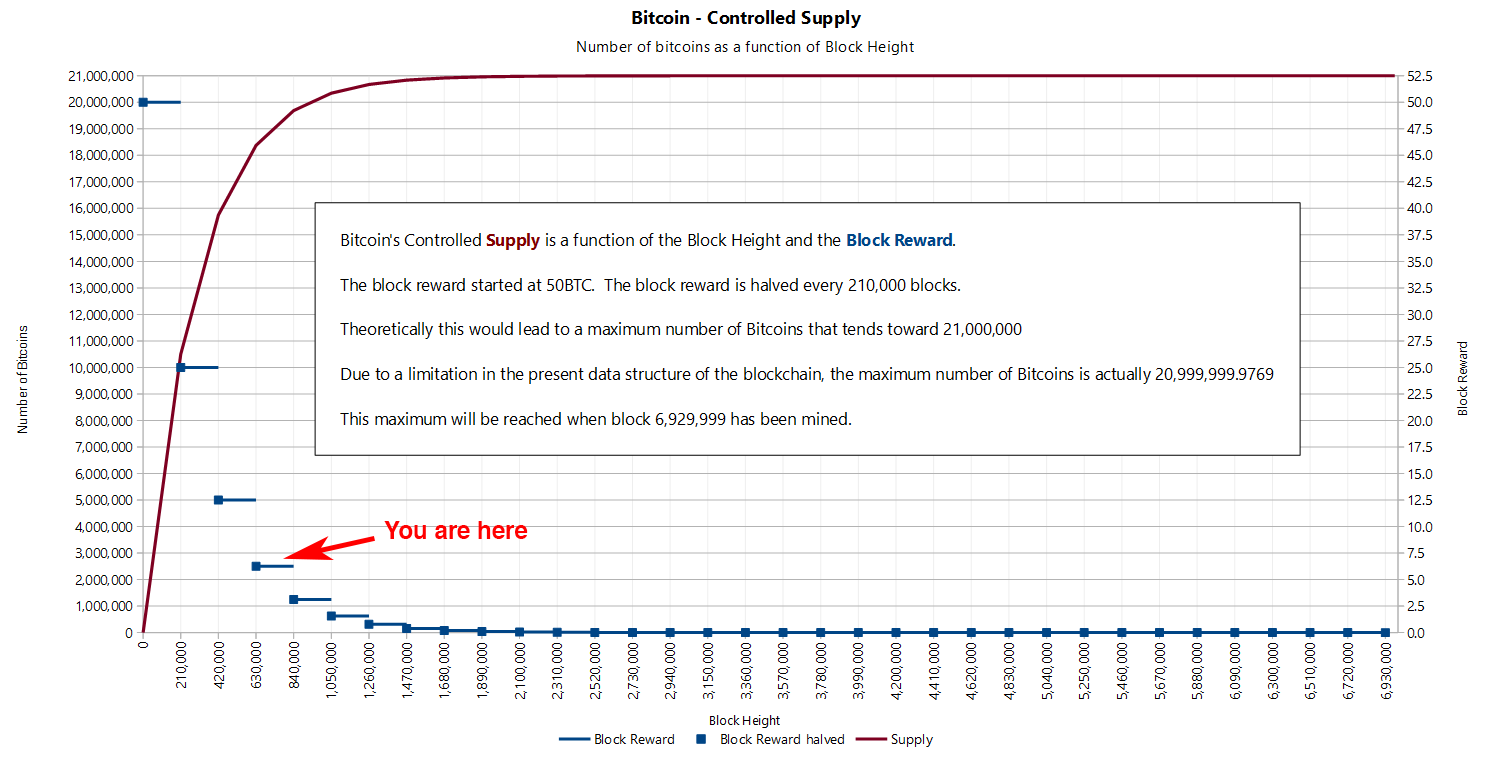

While Bitcoin is still inflationary, it will cease to be so rather soon. The strictly limited supply of 21 million bitcoins will eventually do away with inflation completely. We now have two monetary worlds: an inflationary one where money is printed arbitrarily, and the world of Bitcoin, where final supply is fixed and easily auditable for everyone. One is forced upon us by violence, the other can be joined by anyone who wishes to do so. No barriers to entry, no one to ask for permission. Voluntary participation. That is the beauty of Bitcoin.

I would argue that the argument between Keynesianopen in new window and Austrianopen in new window economists is no longer purely academical. Satoshi managed to build a system for value transfer on steroids, creating the soundest money which ever existed in the process. One way or another, more and more people will learn about the scam which is fractional reserve banking. If they come to similar conclusions as most Austrians and Bitcoiners, they might join the ever-growing internet of money. Nobody can stop them if they choose to do so.

Bitcoin taught me that fractional reserve banking is pure insanity.

Lesson 14: Sound money

The most important lesson I have learned from Bitcoin is that in the long run, hard money is superior to soft money. Hard money, also referred to as sound money, is any globally traded currency that serves as a reliable store of value.

Granted, Bitcoin is still young and volatile. Critics will say that it does not store value reliably. The volatility argument is missing the point. Volatility is to be expected. The market will take a while to figure out the just price of this new money. Also, as is often jokingly pointed out, it is grounded in an error of measurement. If you think in dollars you will fail to see that one bitcoin will always be worth one bitcoin.

"A fixed money supply, or a supply altered only in accord with objective and calculable criteria, is a necessary condition to a meaningful just price of money." - Fr. Bernard W. Dempsey, S.J.open in new window

As a quick stroll through the graveyard of forgotten currencies has shown, money which can be printed will be printed. So far, no human in history was able to resist this temptation.

Bitcoin does away with the temptation to print money in an ingenious way. Satoshi was aware of our greed and fallibility --- this is why he chose something more reliable than human restraint: mathematics.

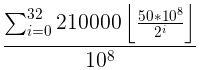

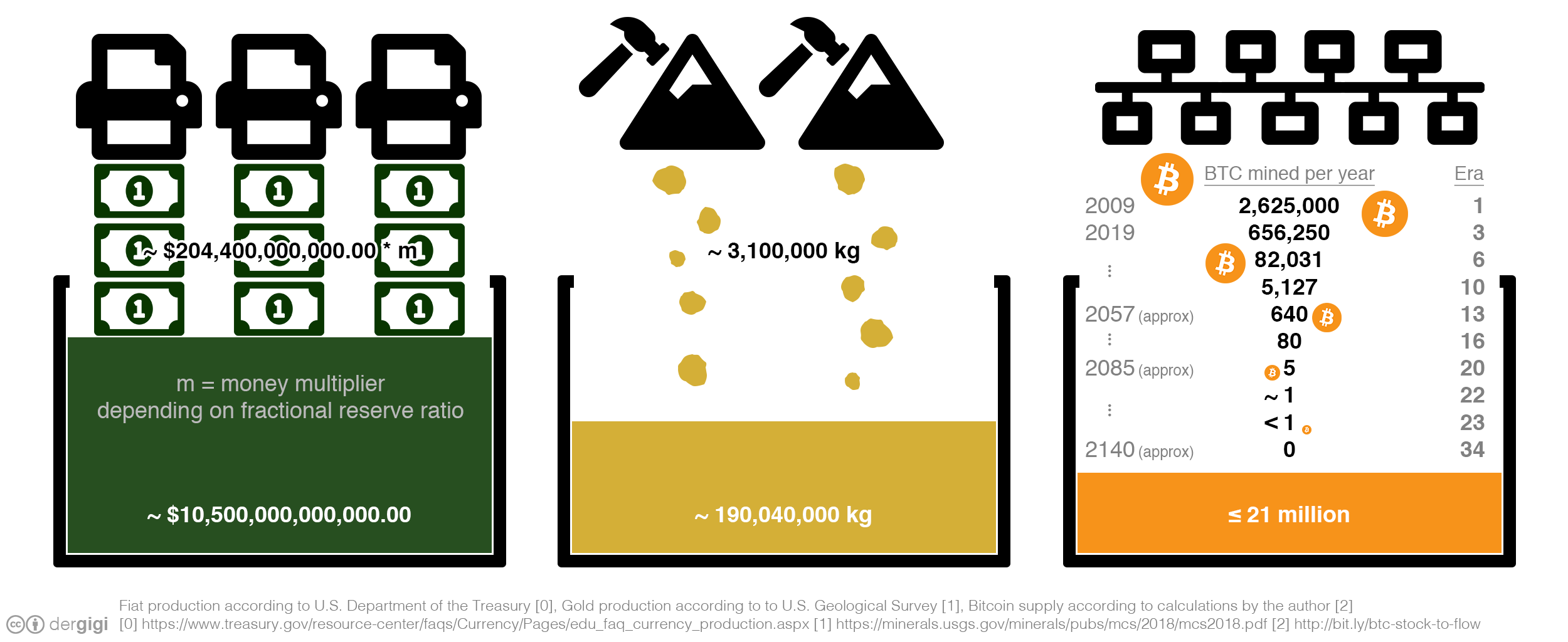

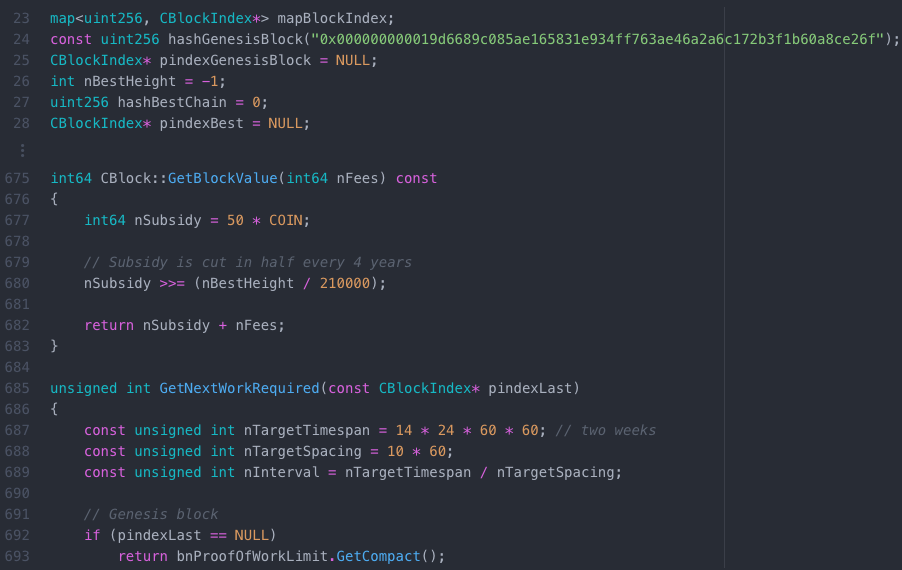

While this formula is useful to describe Bitcoin's supply, it is actually nowhere to be found in the code. Issuance of new bitcoin is done in an algorithmically controlledopen in new window fashion, by reducing the reward which is paid to miners every four years. The formula above is used to quickly sum up what is happening under the hood. What really happens can be best seen by looking at the change in block reward, the reward paid out to whoever finds a valid block, which roughly happens every 10 minutes.

Formulas, logarithmic functions and exponentials are not exactly intuitive to understand. The concept of soundness might be easier to understand if looked at in another way. Once we know how much there is of something, and once we know how hard this something is to produce or get our hands on, we immediately understand its value. What is true for Picasso's paintings, Elvis Presley's guitars, and Stradivarius violins is also true for fiat currency, gold, and bitcoins.

The hardness of fiat currency depends on who is in charge of the respective printing presses. Some governments might be more willing to print large amounts of currency than others, resulting in a weaker currency. Other governments might be more restrictive in their money printing, resulting in harder currency.

Before we had fiat currencies, the soundness of money was determined by the natural properties of the stuff which we used as money. The amount of gold on earth is limited by the laws of physics. Gold is rare because supernovae and neutron star collisions are rare. The "flow" of gold is limited because extracting it is quite an effort. Being a heavy element it is mostly buried deep underground.

The abolishment of the gold standard gave way to a new reality: adding new money requires just a drop of ink. In our modern world adding a couple of zeros to the balance of a bank account requires even less effort: flipping a few bits in a bank computer is enough.

"One important aspect of this new reality is that institutions like the Fed cannot go bankrupt. They can print any amount of money that they might need for themselves at virtually zero cost." - Jörg Guido Hülsmannopen in new window

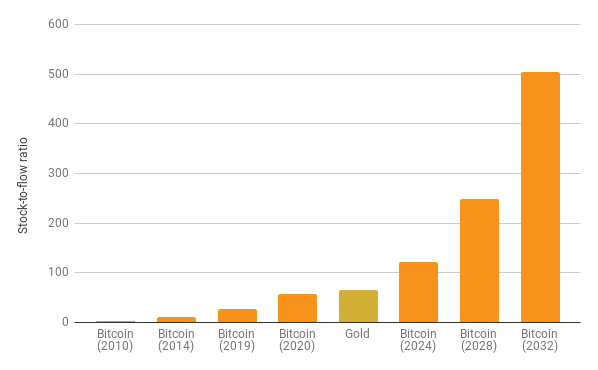

The principle outlined above can be expressed more generally as the ratio of "stock" to "flow". Simply put, the stock is how much of something is currently there. For our purposes, the stock is a measure of the current money supply. The flow is how much there is produced over a period of time (e.g. per year). The key to understanding sound money is in understanding this stock-to-flow ratio.

Calculating the stock-to-flow ratio for fiat currency is difficult, because how much money there isopen in new window depends on how you look at it. You could count only banknotes and coins (M0), add traveler checks and check deposits (M1), add saving accounts and mutual funds and some other things (M2), and even add certificates of deposit to all of that (M3). Further, how all of this is defined and measured varies from country to country and since the US Federal Reserve stopped publishingopen in new window numbers for M3, we will have to make do with the M2 monetary supply. I would love to verify these numbers, but I guess we have to trust the fed for now.

Gold, one of the rarest metals on earth, has the highest stock-to-flow ratio. According to the US Geological Survey, a little more than 190,000 tons have been mined. In the last few yearsopen in new window, around 3100 tons of gold have been mined per year.

Using these numbers, we can easily calculate the stock-to-flow ratio for gold: 190,000 tons / 3,100 tons = ~61.

Nothing has a higher stock-to-flow ratio than gold. This is why gold, up to now, was the hardest, soundest money in existence. It is often said that all the gold mined so far would fit in two olympic-sized swimming pools. According to my calculationsopen in new window, we would need four. So maybe this needs updating, or Olympic-sized swimming pools got smaller.

Enter Bitcoin. As you probably know, bitcoin mining was all the rage in the last couple of years. This is because we are still in the early phases of what is called the reward era, where mining nodes are rewarded with a lot of bitcoin for their computational effort. We are currently in reward era number 4, which began in 2020 and will end in early 2024, probably in May. While the bitcoin supply is predetermined, the inner workings of Bitcoin only allow for approximate dates. Nevertheless, we can predict with certainty how high Bitcoin's stock-to-flow ratio will be. Spoiler alert: it will be high.

How high? Well, it turns out that Bitcoin will get infinitely hard.

Due to an exponential decrease of the mining reward, the flow of new bitcoin will diminish resulting in a sky-rocketing stock-to-flow ratio. It will catch up to gold in 2020, only to surpass it four years later by doubling its soundness again. Such a doubling will occur 64 times in total. Thanks to the power of exponentials, the number of bitcoin mined per year will drop below 100 bitcoin in 50 years and below 1 bitcoin in 75 years. The global faucet which is the block reward will dry up somewhere around the year 2140, effectively stopping the production of bitcoin. This is a long game. If you are reading this, you are still early.

As bitcoin approaches infinite stock to flow ratio it will be the soundest money in existence. Infinite soundness is hard to beat.

Viewed through the lens of economics, Bitcoin's difficulty adjustment is probably its most important component. How hard it is to mine bitcoin depends on how quickly new bitcoins are mined*. It is the dynamic adjustment of the network's mining difficulty which enables us to predict its future supply.

(* It actually depends on how quickly valid blocks are found, but for our purposes, this is the same thing as "mining bitcoins" and will be so for the next 120 years.)

The simplicity of the difficulty adjustment algorithm might distract from its profundity, but the difficulty adjustment truly is a revolution of Einsteinian proportions. It ensures that, no matter how much or how little effort is spent on mining, Bitcoin's controlled supply won't be disrupted. As opposed to every other resource, no matter how much energyopen in new window someone will put into mining bitcoin, the total reward will not increase.

Just like E=mc² dictates the universal speed limitopen in new window in our universe, Bitcoin's difficulty adjustment dictates the universal money limit in Bitcoin.

If it weren't for this difficulty adjustment, all bitcoins would have been mined already. If it weren't for this difficulty adjustment, Bitcoin probably wouldn't have survived in its infancy. It is what secures the network in its reward era. It is what ensures a steady and fair distributionopen in new window of new bitcoin. It is the thermostat which regulates Bitcoin's monetary policy.

Einstein showed us something novel: no matter how hard you push an object, at a certain point you won't be able to get more speed out of it. Satoshi also showed us something novel: no matter how hard you dig for this digital gold, at a certain point you won't be able to get more bitcoin out of it. For the first time in human history, we have a monetary good which, no matter how hard you try, you won't be able to produce more of.

Bitcoin taught me that sound money is essential.

Chapter III: Technology

Golden keys, clocks which only work by chance, races to solve strange riddles, and builders that don't have faces or names. What sounds like fairy tales from Wonderland is daily business in the world of Bitcoin.

As we explored in Chapter 2, large parts of the current financial system are systematically broken. Like Aliceopen in new window, we can only hope to manage better this time. But, thanks to a pseudonymous inventor, we have incredibly sophisticated technology to support us this time around: Bitcoin.

Solving problems in a radically decentralized and adversarial environment requires unique solutions. What would otherwise be trivial problems to solve are everything but in this strange world of nodes. Bitcoin relies on strong cryptography for most solutions, at least if looked at through the lens of technology. Just how strong this cryptography is will be explored in one of the following lessons.

Cryptography is what Bitcoin uses to remove trust in authorities. Instead of relying on centralized institutions, the system relies on the final authority of our universe: physics. Some grains of trust still remain, however. We will examine these grains in the second lesson of this chapter.

- Lesson 15: Strength in numbers

- Lesson 16: Reflections on "Don't Trust, Verify"

- Lesson 17: Telling time takes work

- Lesson 18: Move slowly and don't break things

- Lesson 19: Privacy is not dead

- Lesson 20: Cypherpunks write code

- Lesson 21: Metaphors for Bitcoin's future

The last couple of lessons explore the ethos of technological development in Bitcoin, which is arguably as important as the technology itself. Bitcoin is not the next shiny app on your phone. It is the foundation of a new economic reality, which is why Bitcoin should be treated as nuclear-grade financial software.

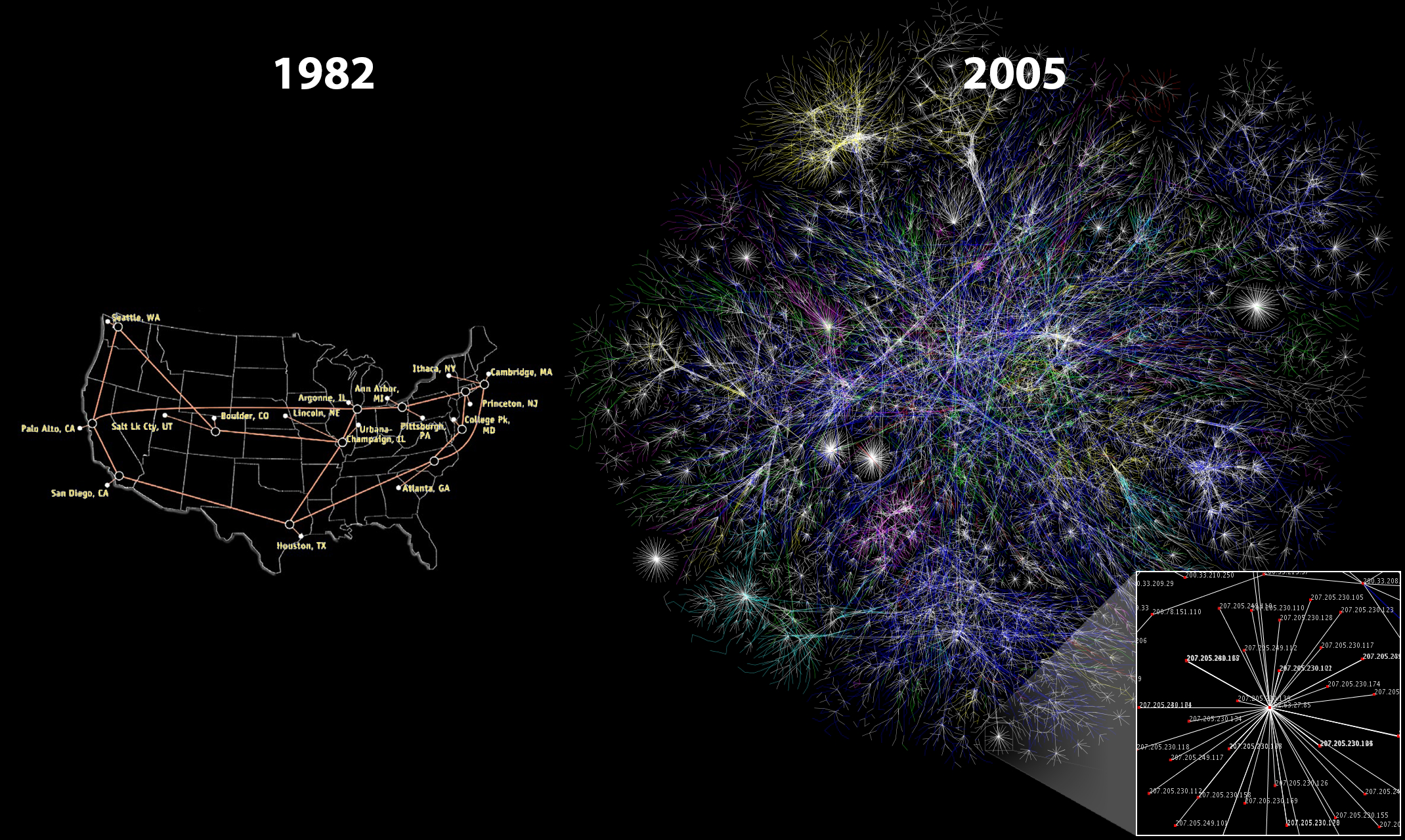

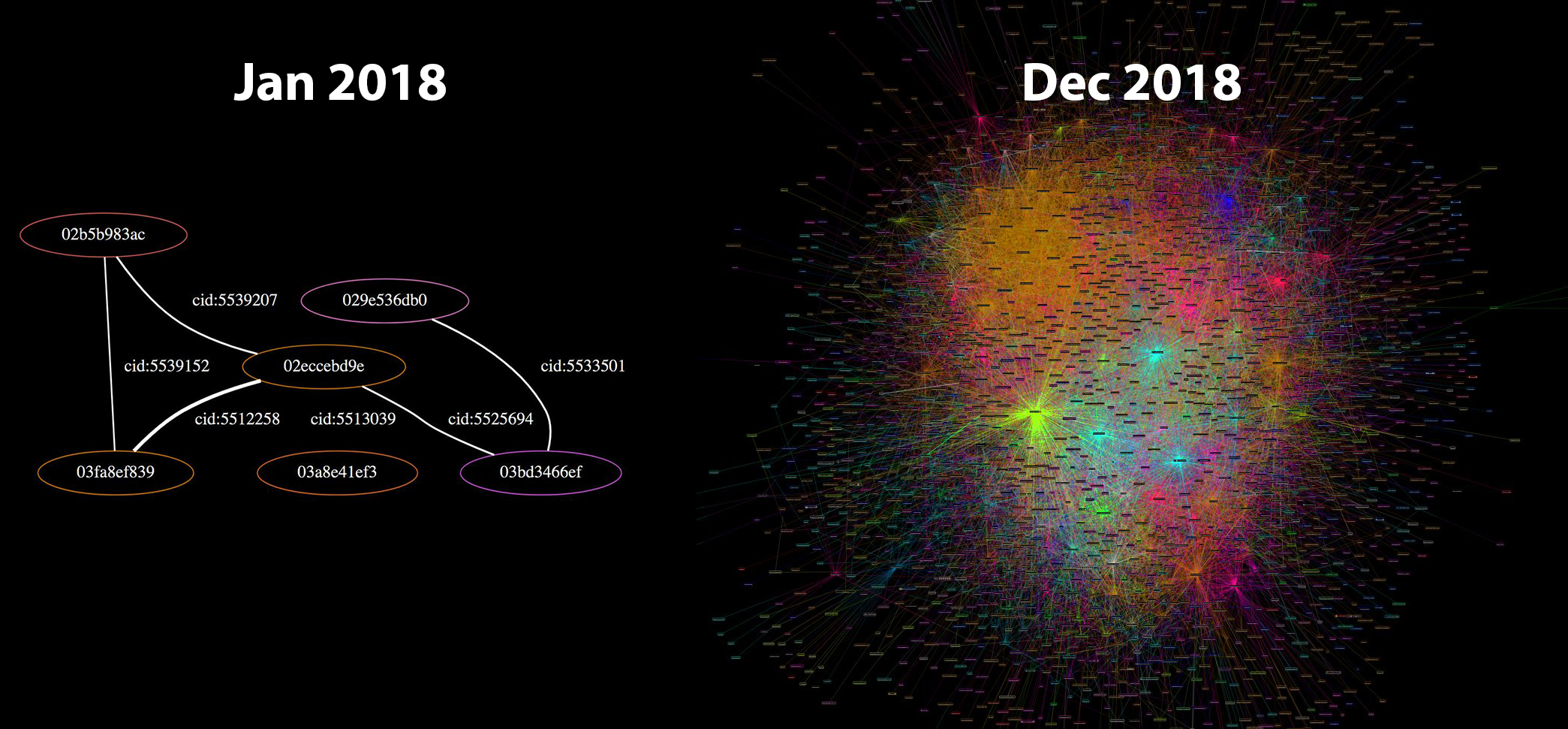

Where are we in this financial, societal, and technological revolution? Networks and technologies of the past may serve as metaphors for Bitcoins future, which are explored in the last lesson of this chapter.

Once more, strap in and enjoy the ride. Like all exponential technologies, we are about to go parabolic.

Lesson 15: Strength in numbers

Numbers are an essential part of our everyday life. Large numbers, however, aren't something most of us are too familiar with. The largest numbers we might encounter in everyday life are in the range of millions, billions, or trillions. We might read about millions of people in poverty, billions of dollars spent on bank bailouts, and trillions of national debt. Even though it's hard to make sense of these headlines, we are somewhat comfortable with the size of those numbers.

Although we might seem comfortable with billions and trillions, our intuition already starts to fail with numbers of this magnitude. Do you have an intuition how long you would have to wait for a million/billion/trillion seconds to pass? If you are anything like me, you are lost without actually crunching the numbers.

Let's take a closer look at this example: the difference between each is an increase by three orders of magnitude: 10⁶, 10⁹, 10¹². Thinking about seconds is not very useful, so let's translate this into something we can wrap our head around:

- 10⁶: One million seconds was 1½ weeks ago.

- 10⁹: One billion seconds was almost 32 years ago.

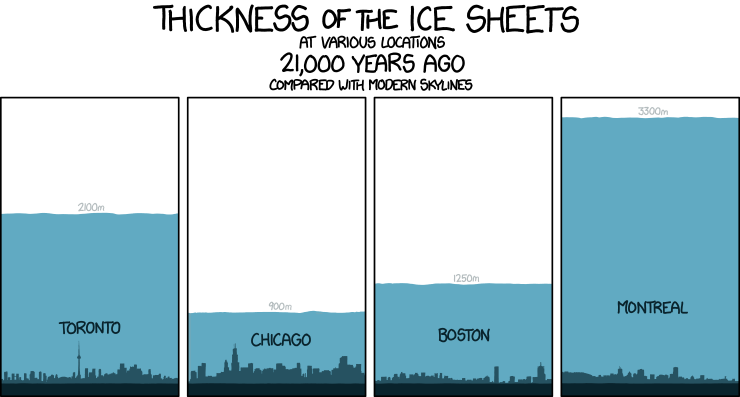

- 10¹²: One trillion seconds ago Manhattan was covered under a thick layer of iceopen in new window.

As soon as we enter the beyond-astronomical realm of modern cryptography, our intuition fails catastrophically. Bitcoin is built around large numbers and the virtual impossibility of guessing them. These numbers are way, way larger than anything we might encounter in day-to-day life. Many orders of magnitude larger. Understanding how large these numbers truly are is essential to understanding Bitcoin as a whole.

Let's take SHA-256open in new window, one of the hash functionsopen in new window used in Bitcoin, as a concrete example. It is only natural to think about 256 bits as "two hundred fifty-six," which isn't a large number at all. However, the number in SHA-256 is talking about orders of magnitude --- something our brains are not well-equipped to deal with.

While bit length is a convenient metric, the true meaning of 256-bit security is lost in translation. Similar to the millions (10⁶) and billions (10⁹) above, the number in SHA-256 is about orders of magnitude (2²⁵⁶).

So, how strong is SHA-256, exactly?

"SHA-256 is very strong. It's not like the incremental step from MD5 to SHA1. It can last several decades unless there's some massive breakthrough attack." - Satoshi Nakamotoopen in new window

Let's spell things out. 2²⁵⁶ equals the following number:

115 quattuorvigintillion 792 trevigintillion 89 duovigintillion 237 unvigintillion 316 vigintillion 195 novemdecillion 423 octodecillion 570 septendecillion 985 sexdecillion 8 quindecillion 687 quattuordecillion 907 tredecillion 853 duodecillion 269 undecillion 984 decillion 665 nonillion 640 octillion 564 septillion 39 sextillion 457 quintillion 584 quadrillion 7 trillion 913 billion 129 million 639 thousand 936.

That's a lot of nonillions! Wrapping your head around this number is pretty much impossible. There is nothing in the physical universe to compare it to. It is far larger than the number of atoms in the observable universe. The human brain simply isn't made to make sense of it.

One of the best visualizations of the true strength of SHA-256 is the following video by Grant Sanderson. Aptly named "How secure is 256 bit security?"open in new window it beautifully shows how large a 256-bit space is. Do yourself a favor and take the five minutes to watch it. As all other 3Blue1Brownopen in new window videos it is not only fascinating but also exceptionally well made. Warning: You might fall down a math rabbit hole.

Bruce Schneieropen in new window used the physical limits of computation to put this number into perspective: even if we could build an optimal computer, which would use any provided energy to flip bits perfectlyopen in new window, build a Dyson sphereopen in new window around our sun, and let it run for 100 billion billion years, we would still only have a 25% chance to find a needle in a 256-bit haystack.

"These numbers have nothing to do with the technology of the devices; they are the maximums that thermodynamics will allow. And they strongly imply that brute-force attacks against 256-bit keys will be infeasible until computers are built from something other than matter and occupy something other than space." Bruce Schneieropen in new window

It is hard to overstate the profoundness of this. Strong cryptography inverts the power-balance of the physical world we are so used to. Unbreakable things do not exist in the real world. Apply enough force, and you will be able to open any door, box, or treasure chest.

Bitcoin's treasure chest is very different. It is secured by strong cryptography, which does not give way to brute force. And as long as the underlying mathematical assumptions hold, brute force is all we have. Granted, there is also the option of a global $5 wrench attackopen in new window. But torture won't work for all bitcoin addresses, and the cryptographic walls of bitcoin will defeat brute force attacks. Even if you come at it with the force of a thousand suns. Literally.

This fact and its implications were poignantly summarized in the call to cryptographic armsopen in new window: "No amount of coercive force will ever solve a math problem."

"It isn't obvious that the world had to work this way. But somehow the universe smiles on encryption." Julian Assangeopen in new window

Nobody yet knows for sure if the universe's smile is genuine or not. It is possible that our assumption of mathematical asymmetries is wrong and we find that P actually equals NPopen in new window, or we find surprisingly quick solutions to specific problemsopen in new window which we currently assume to be hard. If that should be the case, cryptography as we know it will cease to exist, and the implications would most likely change the world beyond recognition.

"Vires in Numeris" = "Strength in Numbers" - epiiopen in new window

Vires in numeris is not only a catchy motto used by bitcoiners. The realization that there is an unfathomable strength to be found in numbers is a profound one. Understanding this, and the inversion of existing power balances which it enables changed my view of the world and the future which lies ahead of us.

One direct result of this is the fact that you don't have to ask anyone for permission to participate in Bitcoin. There is no page to sign up, no company in charge, no government agency to send application forms to. Simply generate a large number and you are pretty much good to go. The central authority of account creation is mathematics. And God only knows who is in charge of that.

Bitcoin is built upon our best understanding of reality. While there are still many open problems in physics, computer science, and mathematics, we are pretty sure about some things. That there is an asymmetry between finding solutions and validating the correctness of these solutions is one such thing. That computation needs energy is another one. In other words: finding a needle in a haystack is harder than checking if the pointy thing in your hand is indeed a needle or not. And finding the needle takes work.

The vastness of Bitcoin's address space is truly mind-boggling. The number of private keys even more so. It is fascinating how much of our modern world boils down to the improbability of finding a needle in an unfathomably large haystack. I am now more aware of this fact than ever.

Bitcoin taught me that there is strength in numbers.

Lesson 16: Reflections on "Don't Trust, Verify"

Bitcoin aims to replace, or at least provide an alternative to, conventional currency. Conventional currency is bound to a centralized authority, no matter if we are talking about legal tender like the US dollar or modern monopoly money like Fortnite's V-Bucks. In both examples, you are bound to trust the central authority to issue, manage and circulate your money. Bitcoin unties this bound, and the main issue Bitcoin solves is the issue of trust.

"The root problem with conventional currency is all the trust that's required to make it work. [...] What is needed is an electronic payment system based on cryptographic proof instead of trust" - Satoshiopen in new window Nakamotoopen in new window

Bitcoin solves the problem of trust by being completely decentralized, with no central server or trusted parties. Not even trusted third parties, but trusted parties, period. When there is no central authority, there simply is no-one to trust. Complete decentralization is the innovation. It is the root of Bitcoin's resilience, the reason why it is still alive. Decentralization is also why we have mining, nodes, hardware wallets, and yes, the blockchain. The only thing you have to "trust" is that our understanding of mathematics and physics isn't totally off and that the majorityopen in new window of miners act honestly (which they are incentivized to do).

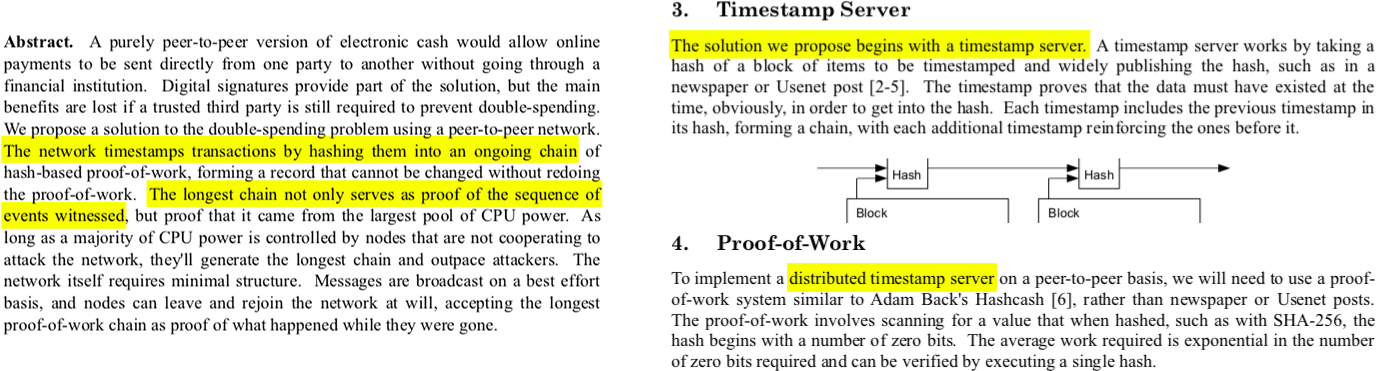

While the regular world operates under the assumption of "trust, but verify," Bitcoin operates under the assumption of "don't trust, verify." Satoshi made the importance of removing trust very clear in both the introduction as well as the conclusion of the Bitcoin whitepaperopen in new window.

"Conclusion: We have proposed a system for electronic transactions without relying on trust."- Satoshi Nakamotoopen in new window

Note that "without relying on trust" is used in a very specific context here. We are talking about trusted third parties, i.e. other entities which you trust to produce, hold, and process your money. It is assumed, for example, that you can trust your computer.

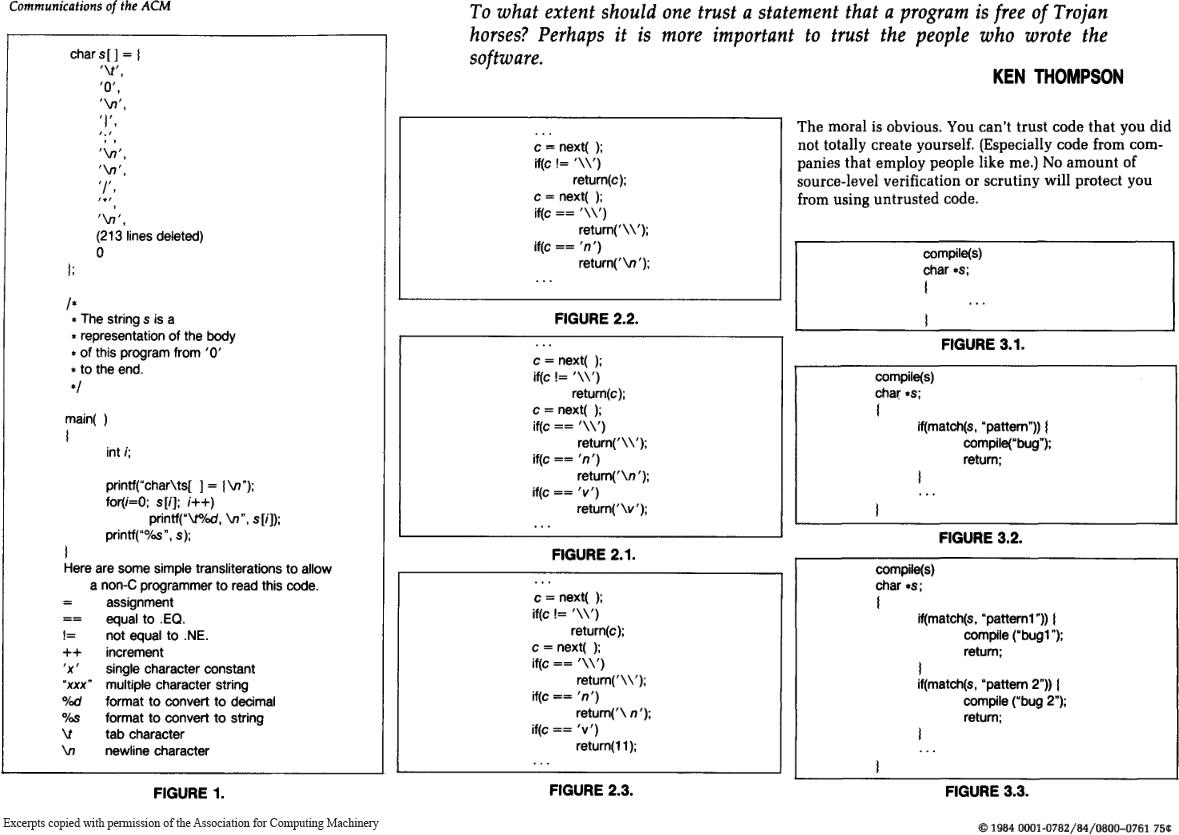

As Ken Thompson showed in his Turing Award lecture, trust is an extremely tricky thing in the computational world. When running a program, you have to trust all kinds of software (and hardware) which, in theory, could alter the program you are trying to run in a malicious way. As Thompson summarized in his Reflections on Trusting Trustopen in new window[]: "The moral is obvious. You can't trust code that you did not totally create yourself."

Thompson demonstrated that even if you have access to the source code, your compiler --- or any other program-handling program or hardware --- could be compromised and detecting this backdoor would be very difficult. Thus, in practice, a truly trustless system does not exist. You would have to create all your software and all your hardware (assemblers, compilers, linkers, etc.) from scratch, without the aid of any external software or software-aided machinery.

"If you wish to make an apple pie from scratch, you must first invent the universe." - Carl Saganopen in new window

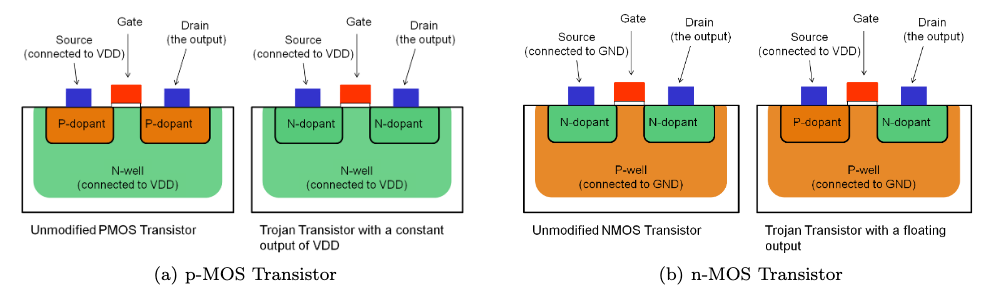

The Ken Thompson Hack is a particularly ingenious and hard-to-detect backdoor, so let's take a quick look at a hard-to-detect backdoor which works without modifying any software. Researchers found a wayopen in new window to compromise security-critical hardware by altering the polarity of silicon impurities. Just by changing the physical properties of the stuff that computer chips are made of they were able to compromise a cryptographically secure random number generator. Since this change can't be seen, the backdoor can't be detected by optical inspection, which is one of the most important tamper-detection mechanism for chips like these.

Sounds scary? Well, even if you would be able to build everything from scratch, you would still have to trust the underlying mathematics. You would have to trust that secp256k1open in new window is an elliptic curve without backdoors. Yes, malicious backdoors can be inserted in the mathematical foundations of cryptographic functions and arguably this has already happenedopen in new window at least once. There are good reasons to be paranoid, and the fact that everything from your hardware, to your software, to the elliptic curves used can have backdoorsopen in new window are some of them.

"Don't trust. Verify."

The above examples should illustrate that trustless computing is utopic. Bitcoin is probably the one system which comes closest to this utopia, but still, it is trust-minimized --- aiming to remove trust wherever possible. Arguably, the chain-of-trust is neverending, since you will also have to trust that computation requires energy, that P does not equal NP, and that you are actually in base reality and not imprisoned in a simulation by malicious actors.

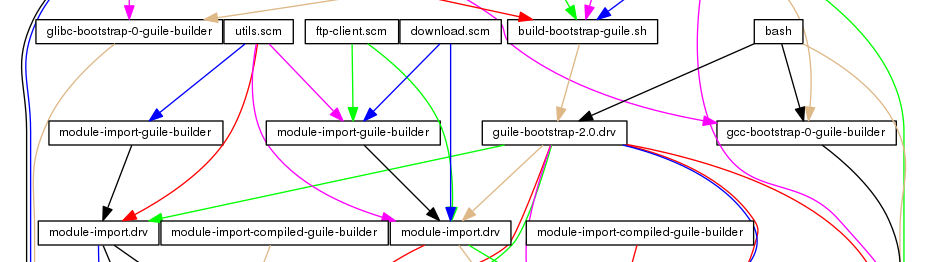

Developers are working on tools and procedures to minimize any remaining trust even further. For example, Bitcoin developers created Gitianopen in new window, which is a software distribution method to create deterministic builds. The idea is that if multiple developers are able to reproduce identical binaries, the chance of malicious tampering is reduced. Fancy backdoors aren't the only attack vector. Simple blackmail or extortion are real threats as well. As in the main protocol, decentralization is used to minimize trust.

Various efforts are being made to improve upon the chicken-and-egg problem of bootstrappingopen in new window which Ken Thompson's hack so brilliantly pointed out. One such effort is Guixopen in new window (pronounced geeks), which uses functionally declared package management leading to bit-for-bit reproducible builds by design. The result is that you don't have to trust any software-providing servers anymore since you can verify that the served binary was not tampered with by rebuilding it from scratch. Recently, a pull-requestopen in new window was merged to integrate Guix into the Bitcoin build process.

Luckily, Bitcoin doesn't rely on a single algorithm or piece of hardware. One effect of Bitcoin's radical decentralization is a distributed security model. Although the backdoors described above are not to be taken lightly, it is unlikely that every software wallet, every hardware wallet, every cryptographic library, every node implementation, and every compiler of every language is compromised. Possible, but highly unlikely.

Note that you can generate a private key without relying on any computational hardware or software. You can flip a coinopen in new window a couple of times, although depending on your coin and tossing style this source of randomness might not be sufficiently random. There is a reason why storage protocols like Glacieropen in new window advise to use casino-grade dice as one of two sources of entropy.

Bitcoin forced me to reflect on what trusting nobody actually entails. It raised my awareness of the bootstrapping problem, and the implicit chain-of-trust in developing and running software. It also raised my awareness of the many ways in which software and hardware can be compromised.

Bitcoin taught me not to trust, but to verify.

Lesson 17: Telling time takes work

It is often said that bitcoins are mined because thousands of computers work on solving very complex mathematical problems. Certain problems are to be solved, and if you compute the right answer, you "produce" a bitcoin. While this simplified view of bitcoin mining might be easier to convey, it does miss the point somewhat. Bitcoins aren't produced or created, and the whole ordeal is not really about solving particular math problems. Also, the math isn't particularly complex. What is complex is telling the time in a decentralized system.

As outlined in the whitepaper, the proof-of-work system (aka mining) is a way to implement a distributed timestamp server.

When I first learned how Bitcoin works I also thought that proof-of-work is inefficient and wasteful. After a while, I started to shift my perspective on Bitcoin's energy consumptionopen in new window. It seems that proof-of-work is still widely misunderstood today, in the year 10 AB (after Bitcoin).

Since the problems to be solved in proof-of-work are made up, many people seem to believe that it is useless work. If the focus is purely on the computation, this is an understandable conclusion. But Bitcoin isn't about computation. It is about independently agreeing on the order of things.

Proof-of-work is a system in which everyone can validate what happened and in what order it happened. This independent validation is what leads to consensus, an individual agreement by multiple parties about who owns what.